Health insurance pays for healthcare expenses for treatments, medicine and services as determined by the coverage features defined in your specific policy. You pay a health insurance premium for the coverage, whether or not you seek medical care.

When you use services covered by your plan, the health insurer pays a portion of your healthcare costs. Depending on the plan type and services used, you may have to pay a share of the bill, as part of the plan’s health insurance deductible (a fixed amount before any coverage begins), copayment (a fixed amount per services) and/or coinsurance (a percentage of the service cost).

Some health plans require that you stay within the provider network if you want the plan to pay for services, while others allow you to seek care out-of-network, usually at a higher cost-sharing percentage for your portion.

Health insurance pays for healthcare expenses for treatments, medicine and services as determined by the coverage features defined in your specific policy. You pay a health insurance premium for the coverage, whether or not you seek medical care.

When you use services covered by your plan, the health insurer pays a portion of your healthcare costs. Depending on the plan type and services used, you may have to pay a share of the bill, as part of the plan’s health insurance deductible (a fixed amount before any coverage begins), copayment (a fixed amount per services) and/or coinsurance (a percentage of the service cost).

Some health plans require that you stay within the provider network if you want the plan to pay for services, while others allow you to seek care out-of-network, usually at a higher cost-sharing percentage for your portion.

What Does Health Insurance Cover?

Health insurance covers doctor visits, hospital visits, outpatient care, preventive care and prescription drugs.

The Affordable Care Act, sometimes called Obamacare, requires health insurance companies in the ACA marketplace at HealthCare.gov to cover:

- Ambulatory patient services, also called outpatient services.

- Emergency services.

- Hospitalizations.

- Lab services.

- Mental health and substance use disorder services.

- Pediatric services, including vision and dental care.

- Pregnancy, maternity and newborn care.

- Prescription drugs.

- Preventive and wellness services, as well as chronic disease management.

- Rehab and habilitative services and devices.

Congress has added other requirements for health insurers beyond the ACA mandate, including birth control coverage and breastfeeding benefits.

Health insurers don’t have to offer dental or vision coverage for adults or medical management programs like weight management, but some insurance companies offer this expanded coverage.

What Does Health Insurance Not Cover?

Health insurance doesn’t cover everything. Services that are often excluded include:

- Alternative treatments, which may include acupuncture.

- Care outside of the U.S.

- Cosmetic surgery.

- Dental care.

- Experimental treatments and drugs.

- Fertility care.

- Hearing aids.

- LASIK surgery.

- Out-of-network care.

- Some prescription drugs.

- Sterilization reversal.

- Vaccines that you need to travel.

- Vision care, though it may cover annual eye exams.

- Weight loss programs and surgery.

The services that health insurance will not cover (or will only partially cover) depend on the health insurance company and plan type. For instance, a health maintenance organization (HMO) or exclusive provider organization (EPO) plan won’t pay for care outside your provider network, while a preferred provider organization (PPO) plan will cover out-of-network care.

How Much Does Health Insurance Cost?

The average cost for a silver plan for a 30-year-old is $488 a month.

- A 40-year-old pays an average of $549 a month.

- A 50-year-old pays an average of $767 a month.

- A 60-year-old pays an average of $1,164 a month.

Health insurance costs vary based on multiple factors, including the metal tier and your age. Bronze and silver plans have cheaper premiums but higher out-of-pocket costs than gold plans.

Bronze Plans: Average Monthly Health Insurance Costs

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Aetna | $335 | $378 | $528 | $802 |

| Ambetter | $370 | $416 | $582 | $884 |

| Blue Cross Blue Shield | $407 | $458 | $641 | $972 |

| Cigna | $382 | $428 | $600 | $907 |

| Kaiser Permanente | $311 | $351 | $490 | $745 |

| Oscar | $348 | $392 | $548 | $833 |

| UnitedHealthcare | $380 | $427 | $597 | $908 |

Average costs are for unsubsidized plans.

Silver Plans: Average Monthly Health Insurance Costs

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Aetna | $424 | $451 | $667 | $1,013 |

| Ambetter | $441 | $497 | $694 | $1,055 |

| Blue Cross Blue Shield | $543 | $611 | $854 | $1,296 |

| Cigna | $454 | $510 | $714 | $1,078 |

| Kaiser Permanente | $423 | $476 | $665 | $1,011 |

| Oscar | $451 | $508 | $709 | $1,078 |

| UnitedHealthcare | $489 | $551 | $770 | $1,170 |

Average costs are for unsubsidized plans.

Gold Plans: Average Monthly Health Insurance Costs

| Company | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Aetna | $413 | $534 | $747 | $1,135 |

| Ambetter | $493 | $555 | $776 | $1,179 |

| Blue Cross Blue Shield | $599 | $674 | $942 | $1,429 |

| Cigna | $578 | $648 | $908 | $1,372 |

| Kaiser Permanente | $435 | $490 | $685 | $1,041 |

| Oscar | $482 | $543 | $759 | $1,153 |

| UnitedHealthcare | $551 | $620 | $867 | $1,317 |

Average costs are for unsubsidized plans.

We didn’t include platinum plan costs because those plans are fairly rare. The ACA marketplace doesn’t have enough platinum plans for us to calculate an accurate average.

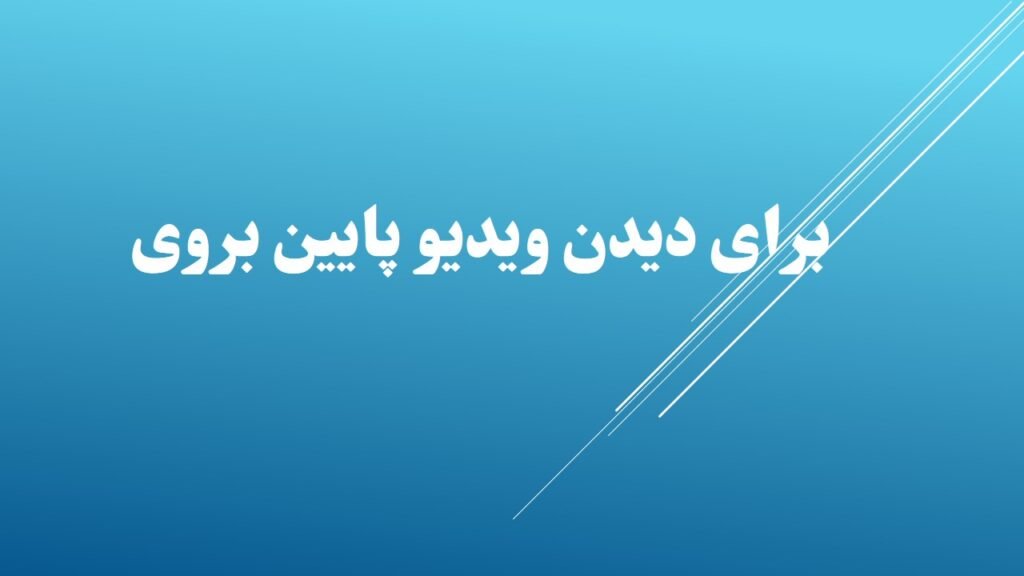

Health Insurance Complaints by Company

UnitedHealthcare was the only health insurance company in our analysis with a complaint level that’s below the industry average.

What Are the Types of Health Insurance Plans?

Health insurance companies offer multiple types of benefit designs, which affect where you can get care, how much you’ll pay and whether you need a referral to see a specialist.

The four most common types of health insurance plans are:

- Preferred Provider Organization (PPO): Preferred provider organization (PPO) plans offer the most flexibility, but that typically comes with higher premiums than other plan types. A PPO allows you to get out-of-network care (but at a higher cost than in-network care). You also don’t need a primary care provider referral to see specialists.

- Health Maintenance Organization (HMO): Health maintenance organization (HMO) plans are generally cheaper than PPOs, but those lower premiums have more restrictions than a PPO. You typically must name a primary care provider, who oversees your healthcare. Referrals are required to see specialists. An HMO only pays for in-network care.

- Exclusive Provider Organization (EPO): Exclusive provider organization (EPO) plans are similar to HMOs and generally cost about the same. They don’t reimburse for out-of-network care, so you should stay in your provider network. EPOs are different from an HMO in that you don’t need a referral to see a specialist.

- Point of Service (POS): Point of service (POS) plans, which are the least common health plan type, combine elements of an HMO and PPO. A POS may cover out-of-network care, just like a PPO, but you generally need to name a primary care provider and they must write a referral for you to see specialists, which is similar to an HMO.